Is your credit union or community bank on Facebook?

Are you looking for better ways to use Facebook to build relationships and attract new clients?

You are DEFINITELY not alone. When we’re working with clients in the banking industry or talking to marketers on our 2-hour Social Media Marketing training calls, there’s a handful of questions that consistently come up around Facebook marketing strategies for credit unions.

- How does the algorithm work?

- What should I be posting?

- How do I know if I’m reaching the right people?

- How can I drive more traffic to my website?

- How do I collect leads from Facebook?

- Is it worth it to pay for advertising on Facebook?

As a marketer, Facebook is awesome. Facebook is frustrating. Facebook can make you want to pull your hair out! But Facebook can also help you make real connections with people in your community who will actually find value in your end offering. Banking may not be the sexiest topic coming through the newsfeed, and it’s easy to make excuses and chalk it up to “the death of organic reach”. But don’t give up on it! You have great, useful content and tips to offer people that will attract them to your institution – even if you don’t know it yet! Use this post as a framework for creating a winning Facebook marketing strategy and start growing your bank on Facebook today. Let’s dive in.

Facebook is the biggest social platform in the world for many reasons, but one of the most critical core values driving its success is its dedication to user experience. Facebook wants to give users the best possible experience to maintain their incredibly high number of daily active users (1.37 billion), and improve the value offered to marketers itching to get their message in front of all those eyeballs.

The power of Facebook comes from the “data machine” of information they’ve accumulated about their users. Even typing that sentence feels creepy… but hey – we’re all on there anyway, and for marketers, it opens up some amazing opportunities to turn marketing dollars into real business results by serving ads to the most relevant audiences. Allocating some of your advertising budget towards Facebook ads is smart for any credit union, but even the organic functionality of how users interact with and share content on Facebook can benefit your business with the right strategy.

Like Facebook, you need to think about how your ideal customers are using the platform. Facebook is obsessively tracking what posts you ‘like’, videos you un-mute, links you click, ads you ‘hide’, business pages you interact with, and literally thousands of other data points that all play a factor in what the algorithm spits into your newsfeed. It’s their goal to show you what they think you’ll be interested in seeing. If you’re not putting effort into your bank’s Facebook strategy, you’re likely hearing crickets after posting.

Before you start blasting out posts telling people to join your credit union or community bank, let’s take a few minutes (literally – that’s all this takes) to get a better understanding of your current Facebook audience and past post performance. If your bank doesn’t have a presence on Facebook yet or your page is still in it’s infancy, this learning strategy won’t be as useful. However, getting acclimated to the Insights section will give you a HUGE advantage as you create posts and begin building a community. Facebook Insights is an awesome tool that’s completely free to use – just log in to the Facebook page you manage and in the main navigation bar up top, select ‘Insights’.

Once you’re in there, spend some time poking your way through the lefthand menu. As a credit union or community bank looking to stay on top of your page’s pulse, figure out which posts are working, and gauge the quality of your audience, focus your effort on the Overview, People, and Posts tabs.

In Overview you’ll see easy-to-digest bits of data giving you a summary about the health of your Facebook page. Number of page likes, reach, post engagement, video views, and more key performance indicators are presented in a way where you can keep tabs on your page with really just a glance – no messing with spreadsheets, crunching numbers, or any of that nonsense.

Moving on to the People tab. Explore this section as a surface level way of gauging your audience quality. As soon as this section opens up you’ll see a bar graph showing gender and age demographics for your Facebook fans, and below that you’ll see breakdowns of the location and language of your fans. If you’re a local credit union or community bank, you’ll want to see as close to 100% of your fans residing in the USA as possible. More importantly, you want the Cities listed to reflect the communities of potential customers you’re trying to reach. At the top of this page you’ll see tabs to see this same data for your followers, the people you’ve reached, and the people who’ve engaged with your Facebook posts or page.

The Posts tab is full of juicy information. Up top you’ll see a chart with three category tabs. Clicking through each of the tabs will load a different graph.

- When Your Fans Are Online – You’ll see a line graph revealing which hours of the day (as well as which day) your Facebook fans are most active on the platform. This is huge! Use the peaks in your graph to help schedule posts during the times you’re most likely to reach the most users.

- Post Types – This section shows a breakdown of your average post reach and average engagement (clicks, reactions, comments, shares) by post type. In a matter of seconds you can see how status updates, link posts, videos, and photos stack up against each other.

- Top Posts from Pages You Watch – You’re given the option to select a handful of other Facebook pages to “watch” – ideally, other local credit unions you compete with or credit union Facebook pages you’d like to emulate. This chart shows recent posts from those pages that have been performing above average.

The bottom of the Posts section holds the biggest treasure trove of useful information. You’ll see a list of all the posts published from your Facebook page with reach and engagement metrics for each. Managing the success of your page posts has never been easier! Easily preview any of your posts with real time engagement, see which posts reach the most people, get an idea of which content receives the most clicks, and here’s the real winner… see which posts don’t perform well and then learn from them. Could you have improved the copy to be more exciting and engaging? Did the post content bring any real value to your audience? This is the section you should spend the most time analyzing – and when I say “most time”, I mean 3 – 5 minutes every few days to see how your posts are doing, and then use that information to plan your content moving forward.

Now that you have a better understanding of your current audience and the content they find engaging, let’s talk about your Facebook posting strategy.

With so many selfies, memes, engagements, babies, and cool videos bombarding the newsfeed, it shouldn’t come as a shock to learn that most people won’t get all jazzed up about an informational post from a credit union. That’s not to say credit unions don’t have a place on Facebook… It’s like we discussed earlier in the post – as a content creator on Facebook you have to think about how the end user is using the platform. Not how you wish they’d use it to somehow benefit your bank.

Smaller credit unions and community banks rely on building relationships with people in the area in order to stay in business. Why should that translate any differently online? Take off your marketing cap for a second; when’s the last time you remember logging in to Facebook hoping to see recent banking rates, or an ad asking you to sign up for a new savings account? I think it’s safe to assume the answer is never.

You need to think of yourself as a media publishing company. Focus on creating highly shareable content that’s helpful to your audience and somehow adds value. Your bank is likely partnering with local organizations or events – celebrate that stuff on Facebook! Take a look at this post from GPO Federal Credit Union in Utica, New York.

They’re sharing their support for Making Strides Against Breast Cancer and doing a bit of a humble brag about their employees volunteering in the community. The photo post format also helps add personality and put a face to their credit union. Super low maintenance, too! This piece of content can be created in seconds – just be diligent about snapping a few pictures from events, come up with effective copy, and post it to Facebook all from a phone.

If you don’t have a blog for your credit union, it’s better late than never. Not only is it crucial for getting found in Google search results, but consistently creating content that compliments the buying process will help move people along the customer journey. Plus, it’s fuel for Facebook posts that add value to potential customers. Think ‘Top # Lists’, ‘# Things to Know Before You…’, or ‘Banks vs. Credit Unions’ for some blog post topics to get you started. Your blog posts shouldn’t only be about the services you offer, or the banking industry at all for that matter. You want to be thinking about highly shareable content that is relevant to the audience in your area. ‘# Restaurants near (the area you operate in) You Need To Try This Weekend’, or ‘# Reasons to Love (the area you operate in)’, are smart places to start. You can see how someone on Facebook would be more likely to share a post like that versus one pushing banking services.

Another example of an awesome Facebook post is this one from Generations Federal Credit Union. It’s a “52-Week Money Saving Challenge” that shows how much money you could stash away by saving $1 the first day, $2 the second day, $3, the third, and so on. It’s a simple and lighthearted post, but it could actually bring real monetary value to people who participate in the challenge, which could put you at the top of their consideration set for which credit union to join.

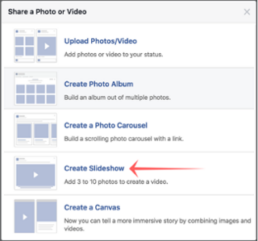

If you’re active on Facebook from your personal profile, you’ve likely noticed an increase in the amount of videos you see in your newsfeed. Facebook has been rolling out countless new features emphasizing their video as their main focus: Facebook Live, autoplay videos, captions for muted videos, to name a few. Since the latter part of 2016, we’ve noticed a huge boost in organic reach and engagement for our clients when posting videos to Facebook. These don’t need to be fancy or over produced! Again, like the image posts, these can be recorded and posted right from your phone. Here’s a #protip for you… Rather than uploading a single image when creating a page post, select the option to Create Slideshow and upload anywhere from 3 – 10 images. You can reorder the images and add music from a bank of available Facebook approved tunes to create a video slideshow that autoplays in the newsfeed. Facebook treats these like regular video posts, and you’ll see a nice boost in reach if you use them.

Contests and polls are a great way to grow and engage your audience. You can partner with local organizations to run giveaways or incentives, tie an activity to a specific cause or initiative, or run promotions for college students to open yourself up to a younger demographic. While posting with the ultimate goal of self-benefit has it’s place in your strategy, it’s also a smart idea to share content posted by other Facebook pages operating in your area. Maybe a new daycare just opened and posted pictures from their ribbon cutting ceremony. Share it and congratulate them! Not only will it strengthen your relationships with other businesses in your community, but it will also help bridge the gap between the two different groups of potential customers.

Hopefully the wheels are starting to turn with content ideas to engage your Facebook fans. As a general rule of thumb, we recommend credit unions and community banks post 5-7 times each week. That may sound like a lot, but not all of your fans will see each post and they won’t all be online at the same time. Minimize your stress and workload by scheduling out your posts a couple days in advance when possible.

Sweet – now you’re in the rhythm of posting high quality content and people are starting to follow along. Let’s start sending traffic and potential leads to landing pages on your website!

To move the needle beyond vanity metrics of Facebook fans and post ‘likes’, you need to start sending engaged Facebook users to your website with the goal of completing an action. The most effective way of turning website traffic into leads is through the use of landing pages, which are pages built to encourage a specific action. Common landing page actions include signing up for an email list, downloading an eBook or white paper, watching a video… You’ve probably landed on your fair share. It’s important to have a number of these high-converting landing pages on your website to make them the most relevant as possible for the audience you’re sending there. For example, if the Facebook post is about tips for saving for your kid’s college fund, the link should go to the landing page with a downloadable eBook with “21 Tips for Growing a College Savings Fund,” not a general landing page asking users to join your email list. These pages are critical to moving potential customers through your sales funnel and should be given some strategic thought.

So what makes a high-converting landing page?

Landing pages should be laser focused on one goal. The overall page should have minimal distractions – meaning, the only thing people should be able to do is the thing you want them to do. Remove any unnecessary menus, links, buttons, and use a clean layout and color scheme to keep it easy on the eyes. Genuine urgency and scarcity tactics tend to increase conversion rates, so you could try adding a countdown timer or a promo end date to encourage immediate action. This should go without saying, but your landing page should have perfect spelling and grammar. Nothing makes your conversion rate look more like a donut than a spelling mistake in your call-to-action.

Click here for an example of one of our highest converting landing pages.

You don’t need to include a link in all of your Facebook posts, but we recommend adding them to about half of them. If you’re adding a link into the main text area of your post, use a cleaner, shortened link through a free service like bitly.com to avoid having a long messy looking URL in your post.

With today’s culture of mobile, speed, and instant results, people expect to be able to reach out to your business on Facebook and get a response as immediate as possible. Facebook is a social platform, and there should be real humans behind the screen that engage with all comments, reviews, and post shares. Ideally your response time should be less than one hour with a response rate of 100% to give people the ultimate customer experience. Linking up your page on the Facebook Business Page app is a nice hack to make your life easier.

Positive comments are easy to engage with, and usually just require a simple “like” or “thank you!”, but the real flames can erupt from mishandled negative comments or reviews.

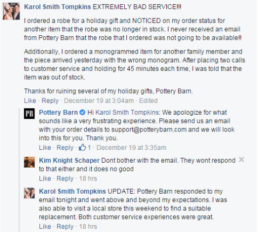

They’re nearly impossible to avoid, but flip your mindset and consider them an opportunity to demonstrate exceptional customer service and turn a negative to a positive. Remember, this is the internet. You’re not just responding to the commenter, you’re responding for everyone to see. First things first, never instigate negative feedback or respond in a defensive or attacking tone. You’ll never win that battle. Instead, show empathy and use the appropriate tone. Use their name, and as quickly as possible, try to direct the conversation either offline to email or to a private direct message on Facebook. And finally, be sure to thank them for their feedback and let them know you care. Take a look at this example of flawless execution from Pottery Barn.

Okay. You’re monitoring the performance of your posts and audience growth with Facebook Insights, you’ve got a flourishing content strategy, leads are rolling in from your landing pages, and you’re handling the positives and negatives of digital customer service. It’s time to kick things up a notch.

Facebook advertising rocks. There may have been a time where they only worked for specific industries, but that day is long gone. As Facebook’s pool of monthly active users continues to soar over 2 billion, the “Facebook machine” gets smarter and compiles more data about its users. All of this data combined with Facebook’s robust ad formats and ad dashboards give marketers an unparalleled opportunity to put the right message in front of the right people at the right time. Advertisers can use data points like purchasing behavior, family size, household type, personal interests, demographics, geographic locations, marital status, you name it. Sounds creepy, right?! But as a credit union or community bank, it means you can build and target an audience of potential customers that are extremely likely to find value in what you have to say.

Facebook ads without a doubt provide today’s marketers with the best bang for their buck in terms of digital spend. And with such amazing analytics and conversion tracking options, we’re able to know exactly how much return we’re getting on those ad dollars. Organic Facebook efforts are paramount engaging your online community, but Facebook ads are the lighter fuel to your marketing funnels to drive a higher number of leads through your landing pages.

Growing a Facebook page that drives real business results for your credit union or community bank won’t happen overnight. It’s a long-term strategy that basically boils down to a requirement for playing on the same level as leaders in the banking industry. These Facebook marketing strategies should set your compass in the right direction, and hopefully you have some actionable takeaways to start implementing today.

If you need help setting up, targeting, running, or scaling your Facebook ads, our team of experts is fluent in building out campaigns to help you drive traffic to converting landing pages, build awareness around your services, promote blog content, move customers down your sales funnel, and more.

Does your social media marketing strategy need a little guidance? We’re helping organizations transform their digital marketing efforts through personalized 2 hour, 1-on-1 trainings. These trainings include:

- Audit of your Facebook, Instagram, & Snapchat accounts

- Maximizing your social media marketing organically

- Customized strategy for running ads that convert

- Copies of presentation & notes to review on your own

- Actionable tips to start winning on social media

Learn more through the button below and see if it’s the right fit for you & your team!